TECHREO drives financial inclusion in Bolivia with technological solutions

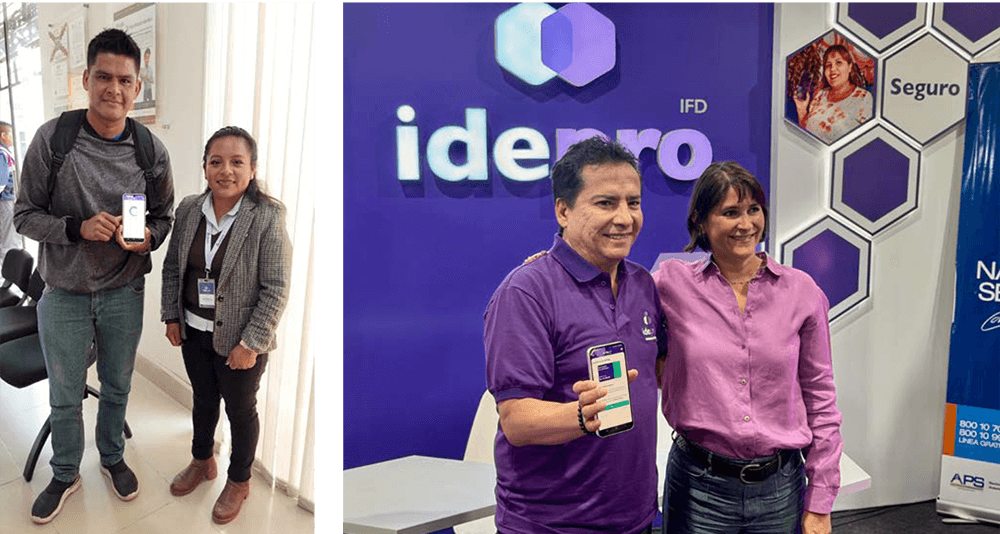

The Mexican company provides access to digital financial products to communities generally underserved by traditional banking, in partnership with Idepro IFD of Bolivia.

ISSUE 140 | 2025

Abner Flores

The Mexican company Techreo, specialized in technological solutions for financial institutions, has strengthened its presence in Bolivia through a strategic alliance with Idepro IFD. Its main goal is to provide access to digital financial products for historically underserved sectors, offering tools such as savings accounts, loans, and bank transfers through an intuitive and secure application.

“We work with traditional entities that have been close to communities and have supported underbanked people.”

Iliana de Silva, CEO and co-founder of Techreo, highlighted in ENERGÍABolivia that the company was founded three years ago with the mission of supporting financial institutions in their digital transformation. “We work with traditional entities that have been close to communities and have supported underbanked people. Through our technology, we facilitate access to essential financial products such as savings, credit, insurance, and transfers,” she stated.

One of the main challenges in Bolivia has been the financial inclusion of rural communities with limited access to banking services. To address this, Techreo has implemented an application that integrates with Idepro IFD’s banking system. Through a biometric verification process, users can open a digital account and access services such as fixed-term deposits and loans for entrepreneurship. “Our application is simple, easy to use, and highly secure. We conduct security tests every six months to ensure the protection of our clients’ data and funds,” de Silva assured.

IMPACT

Techreo’s impact in Bolivia has been significant. In partnership with Idepro IFD, they have achieved a milestone in national deposits, surpassing 11 million dollars in fixed-term deposits. “In times of crisis, people in the microfinance sector tend to save more and borrow less. Attractive rates and the ease of the process have contributed to this success,” explained Techreo's CEO.

In addition to savings services, Techreo and Idepro IFD have developed an innovative digital microcredit system, currently in the pilot phase in Santa Cruz. “This product is 100% digital and eliminates the need for customers to travel to a bank branch, allowing them to optimize their time and easily access financing for their businesses,” added de Silva.

With over 65,000 active users in Bolivia, Techreo continues to design new solutions to strengthen financial inclusion in the region. “Our hybrid model, which combines technology with in-person support, facilitates digital adoption and ensures that as many people as possible can benefit from these financial services,” concluded de Silva.

“In times of crisis, people in the microfinance sector tend to save more and borrow less…”