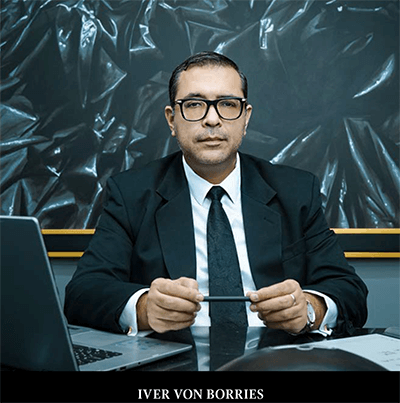

IVER VON BORRIES AND JAVIER ROMERO MENDIZÁBAL: "Bolivia Could Position Itself as a Leader in the Use of Emerging Financial Technologies"

Renowned corporate lawyers Iver von Borries and Javier Romero Mendizábal have submitted a draft bill to the Senate aimed at addressing the issue of maintaining the value of the Bolivian currency. This initiative seeks to amend Law 2434 by explicitly recognizing Tether (USDT), a stablecoin currently listed on the Central Bank of Bolivia’s electronic board, for use in indexing contracts and financial transactions in Bolivia.

ISSUE 137 | 2024

Vesna Marinkovic U.

1How did the initiative to present a draft bill to the Senate, aimed at solving the issue of maintaining the value of the Bolivian currency in the current economic context, come about?

IVB: The initiative arose from Bolivia’s current economic situation, characterized by uncertainty in the exchange rate and the devaluation of the boliviano. Large sums of money, both from public and private funds, are not being allocated or contracted due to the volatility and lack of confidence in the official exchange rate. This creates insecurity for bidders and contractors. The draft bill seeks to adapt existing regulations to new economic and financial realities by recognizing Tether (USDT) as a stable cryptocurrency for contract indexing, which would help preserve the value of transactions and provide greater stability to economic relationships in the country.

2In this context, will it be difficult to modify Law 2434 to recognize Tether (USDT) as a valid and reliable index for updating values in civil and commercial contracts in the country?

JRM: It all depends on the political will in the Plurinational Legislative Assembly. The project aims precisely to explicitly recognize Tether (USDT) as a stable cryptocurrency to be used in the indexing of contracts and restore the balance lost to date. The modification is designed to adapt to current technological and financial realities. Additionally, the project has the support of prominent Bolivian economists and the Santa Cruz Bar Association, which could facilitate its processing.

3If this modification to Bolivian regulations is achieved, would Tether be used in transactions between private individuals, businesses, and public entities?

IVB: Yes, if the modification is approved, Tether (USDT) could be used validly in transactions between private individuals, businesses, and public entities for contract indexing. This would allow parties to use USDT as a reference index for updating amounts and values in civil and commercial contracts, facilitating transactions and contracts in an uncertain economic context.

“Everything depends on the political will in the Plurinational Legislative Assembly. The project aims precisely to explicitly recognize Tether (USDT) as a stable cryptocurrency...”

4Could this measure provide legal and contractual stability among the country's economic actors?

JRM: Indeed, the measure could provide greater legal and contractual stability. By allowing the use of Tether (USDT) as a valid index for value updating, the parties to a contract would have a more reliable and stable mechanism to adjust agreed amounts, reducing uncertainty about inflation and the devaluation of the Bolivian currency. This would create a safer environment for negotiations and transactions, both between private individuals and between public and private companies.

5If this bill becomes a reality, could Bolivia position itself globally in the financial and technological fields?

IVB: We believe so; if this bill is passed, Bolivia could position itself as a leader in the use of emerging financial technologies such as cryptocurrencies and blockchain. Recognizing Tether (USDT) as a valid index in contracts could attract investment and increase trust in the Bolivian financial system, while paving the way for the development of new, more modern contractual and financial practices aligned with global trends in fintech and blockchain.

6What would be the necessary steps and time required to have this regulation in place?

JRM: The necessary steps to have this regulation would include the process of socialization with business and economic entities, the debate and analysis of the relevant committees in the ALP (Plurinational Legislative Assembly), and finally, the approval and promulgation of the amending law by the Plurinational Legislative Assembly. The project has already been submitted to Senator Erick Morón, an economist by profession, who has committed to socializing it. The time required to have this regulation in place will depend on how quickly the aforementioned steps are processed and approved.