IN 2024, THE WORLD'S MAJOR CENTRAL BANKS EXPANDED LIQUIDITY, ENDING THE RESTRICTIVE MONETARY CYCLE

ISSUE 140 | 2025

ENERGÍABolivia (*)

Since the second quarter of 2024, the world's major central banks have expanded liquidity, marking the end of the restrictive monetary policy cycle that began in 2022 to combat rising inflation rates.

According to ECLAC, during that period, the monetary supply growth rate was 0.9% in the United States, 1.3% in Japan, 0.7% in the United Kingdom, and 1.7% in the eurozone. The organization further states that in the third quarter, with the exception of Japan, liquidity expansion intensified (2.0% in the United States, 2.2% in the United Kingdom, and 2.8% in the eurozone) (see Graph 1).

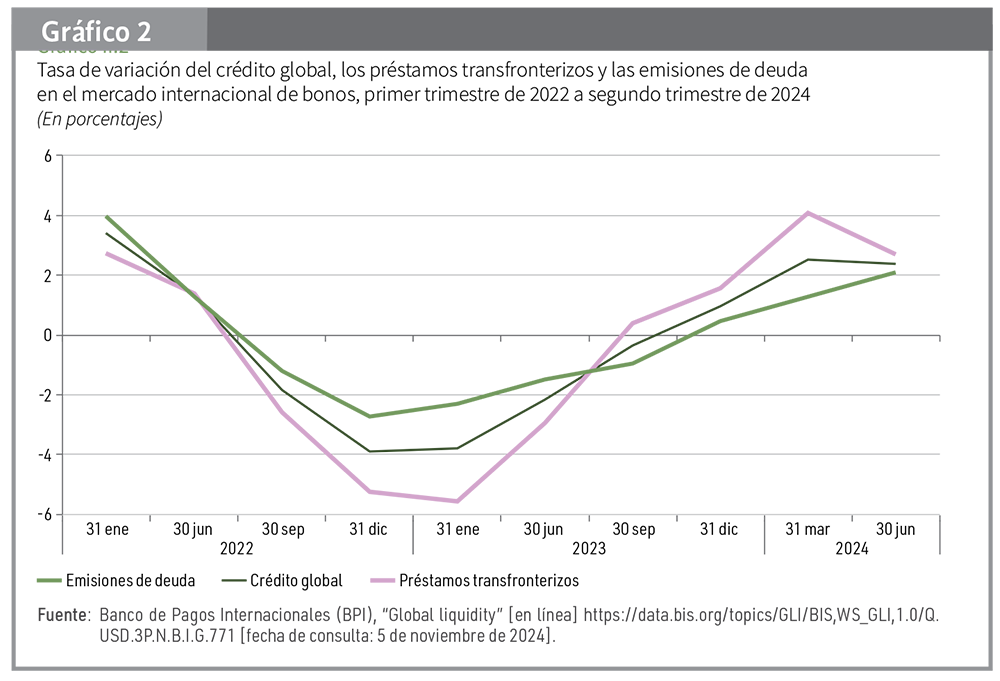

It states that, in line with the evolution of the monetary supply from the world's major central banks, global credit granted to the non-financial sector showed an upward trend and a clear recovery in the first two quarters of 2024 (2.5% growth in the first half and 2.4% in the second quarter), compared to the contraction experienced in 2023 (an average of -1.4%).

CREDIT BREAKDOWN

The analysis indicates that the breakdown of credit into cross-border loans and debt issuance in the international bond market shows that the former expanded by 2.7%, while the latter grew by 2.1% in the second quarter of 2024 (see Graph 2).

"The behavior of global liquidity is partly explained by the reduction in monetary policy interest rates. In September 2024, the Federal Reserve of the United States decided to lower the federal funds rate for the first time since March 2020 by 50 basis points, bringing it from a range of 5.25% to 5.50% to a range of 4.75% to 5.00%," it highlights.

Subsequently, it notes that in November, the Federal Reserve again reduced the federal funds rate by 25 basis points, bringing it to a range of 4.50% to 4.75%.

“...the interest rate cuts are in response to the decrease in the inflation rate and the expectation of inflation aligning with the established targets...”

THE GOVERNING COUNCIL

It further states that the Governing Council of the European Central Bank (ECB) decided on three occasions (June, September, and October 2024) to reduce its monetary policy interest rate by 25 basis points, lowering it from 4.00% to 3.25%. "This is the first time in 13 years that the ECB has adopted an expansive monetary policy. For its part, the Bank of England reduced its monetary policy rate from 5.00% to 4.75% in November," it notes.

It points out that the Bank of Japan did not modify its interest rate and kept it around 0.25%. It adds that the interest rate cuts are due to the decrease in the inflation rate and the expectation of inflation aligning with the established targets (2% for the world’s major central banks), as well as the goal of preventing the weakening of economic growth and the labor market.

ENERGY PRICES

CEPAL states that the rate of change in global energy prices, which had reached a historic peak of 168% in October 2021, has been decreasing since August 2022. "Between January 2023 and September 2024, global energy prices consistently contracted (except in June and July 2024)," it notes.

It adds that in September 2024, the rate of change in global energy prices stood at -16.7%. Similarly, it indicates that food inflation fell from a peak of 10.9% in July 2022 in the United States and 17.9% in May 2023 in the eurozone to lows of 2.3% and 1.4% in September 2024, respectively.

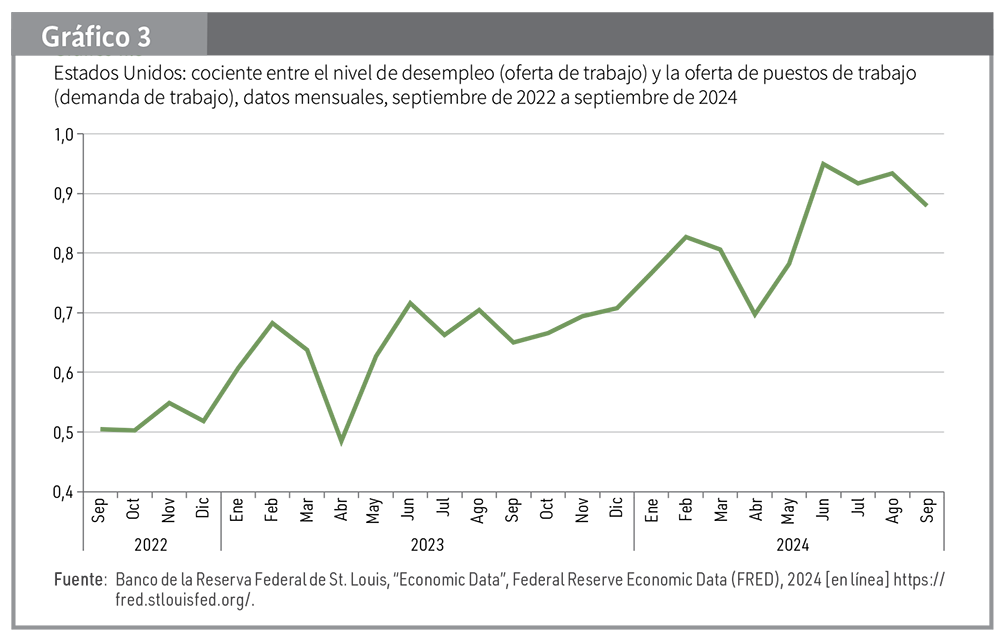

Moreover, pressures in the labor market have eased. In the United States, the unemployment rate remained stable at 4.1% in October 2024, the lowest level recorded since 2000, reflecting the general strength of the labor market. However, an analysis of the labor market shows that since April 2023, the ratio between the unemployment level (labor supply) and the number of job openings (labor demand), both expressed in numbers, has shown an upward trend (see Chart 3).

It concludes by noting that the latest labor market survey, published in the United States in November 2024, shows that the unemployment rate (4.2%) has hardly changed.

(*) Economic Commission for Latin America and the Caribbean (ECLAC), Preliminary Balance of the Economies of Latin America and the Caribbean, 2024 (LC/PUB.2024/27-P), Santiago, 2024.